Ethereum is a decentralized, open-source blockchain platform that enables developers to build and deploy smart contracts and decentralized applications (dApps). Launched in 2015 by Vitalik Buterin and a team of co-founders, Ethereum has become the second-largest cryptocurrency platform by market capitalization, following Bitcoin. The native cryptocurrency of the Ethereum network is Ether (ETH), which serves multiple purposes within the ecosystem.

It is used to pay for transaction fees, computational services, and as a means of value transfer between users. Unlike Bitcoin, which primarily functions as a digital currency, Ethereum’s versatility allows it to support a wide range of applications, from decentralized finance (DeFi) to non-fungible tokens (NFTs). The Ethereum network operates on a unique consensus mechanism known as Proof of Stake (PoS), which was fully implemented with the Ethereum 2.0 upgrade.

This transition from the previous Proof of Work (PoW) system aims to enhance scalability, security, and energy efficiency. In PoS, validators are chosen to create new blocks based on the amount of ETH they hold and are willing to “stake” as collateral. This shift not only reduces the environmental impact associated with mining but also encourages users to hold their ETH, thereby potentially increasing its value over time.

Understanding these foundational aspects of Ethereum and ETH is crucial for anyone looking to engage with this dynamic ecosystem.

Setting up a Wallet for ETH

To interact with the Ethereum network and manage your Ether, setting up a digital wallet is essential. Wallets come in various forms, including hardware wallets, software wallets, and mobile wallets, each offering different levels of security and convenience. Hardware wallets, such as Ledger Nano S or Trezor, are physical devices that store your private keys offline, making them highly secure against online threats.

On the other hand, software wallets like MetaMask or MyEtherWallet provide a more user-friendly experience but are more susceptible to hacking if not properly secured. When setting up a wallet, it is crucial to follow best practices for security. This includes creating strong passwords, enabling two-factor authentication (2FA), and regularly backing up your wallet information.

Additionally, users should be aware of phishing scams that target wallet holders. Always ensure that you are accessing official websites and never share your private keys or recovery phrases with anyone. By taking these precautions, you can safeguard your assets while enjoying the benefits of the Ethereum network.

Looking to dive into the world of crypto? A great place to begin is to start trading ETH. Ethereum is one of the most widely used cryptocurrencies, offering strong liquidity and daily market movement. MEXC provides a user-friendly platform where you can trade ETH against USDT and other pairs. With real-time charts and low trading fees, it’s perfect for beginners and pros alike. Make your first trade today and explore the power of ETH in the market.

Choosing a Reliable Exchange for Trading ETH

Selecting a reliable cryptocurrency exchange is a critical step for anyone looking to trade Ether. The exchange you choose can significantly impact your trading experience in terms of fees, security, and available trading pairs. Some of the most popular exchanges for trading ETH include Coinbase, Binance, Kraken, and Bitfinex.

Each platform has its own unique features; for instance, Coinbase is known for its user-friendly interface and educational resources for beginners, while Binance offers a wider variety of trading options and lower fees. When evaluating an exchange, consider factors such as liquidity, which affects how easily you can buy or sell ETH without causing significant price fluctuations. Additionally, examine the exchange’s security measures, including cold storage practices and insurance policies against hacks.

Regulatory compliance is another important aspect; exchanges that adhere to local laws and regulations tend to be more trustworthy. Reading user reviews and conducting thorough research can help you make an informed decision about which exchange best suits your trading needs.

Learning the Basics of Trading ETH

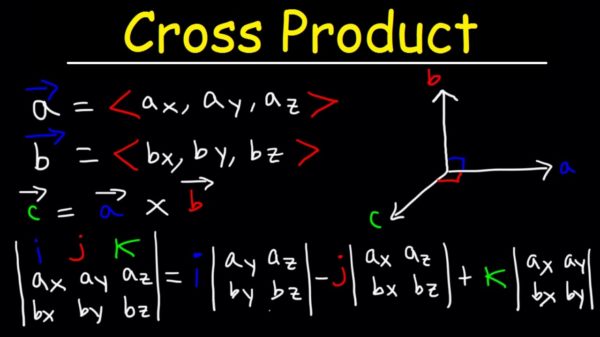

Once you have set up your wallet and chosen an exchange, it’s time to delve into the basics of trading Ether. Trading involves buying and selling ETH with the aim of making a profit based on price fluctuations. Understanding market trends is essential; traders often analyze charts and indicators to identify potential entry and exit points.

Familiarizing yourself with concepts such as candlestick patterns, support and resistance levels, and moving averages can provide valuable insights into market behavior. In addition to technical analysis, it’s important to grasp fundamental analysis when trading ETH. This involves evaluating external factors that could influence the price of Ether, such as news events, regulatory changes, or advancements in Ethereum’s technology.

For example, announcements regarding upgrades to the Ethereum network or significant partnerships can lead to price surges or declines. By combining both technical and fundamental analysis, traders can develop more comprehensive strategies that enhance their chances of success in the volatile cryptocurrency market.

Managing Risks and Setting Goals

Risk management is a crucial aspect of trading that often determines long-term success or failure. The cryptocurrency market is notoriously volatile; prices can swing dramatically within short periods. To mitigate risks, traders should establish clear risk management strategies that include setting stop-loss orders to limit potential losses on trades.

A stop-loss order automatically sells your ETH when it reaches a predetermined price point, helping you avoid significant losses during market downturns. In addition to risk management strategies, setting realistic trading goals is essential for maintaining discipline and focus. Traders should define their objectives clearly—whether it’s achieving a specific percentage return on investment or accumulating a certain amount of ETH over time.

By setting measurable goals and regularly reviewing progress, traders can stay motivated and make informed decisions rather than succumbing to emotional reactions during market fluctuations.

Staying Informed and Adapting to Market Changes

The cryptocurrency landscape is constantly evolving; staying informed about market trends and developments is vital for successful trading. Following reputable news sources, joining online communities such as Reddit or Discord groups focused on Ethereum, and subscribing to newsletters can provide valuable insights into market sentiment and emerging trends. Additionally, engaging with social media platforms like Twitter can help traders stay updated on real-time developments within the Ethereum ecosystem.

Adapting to market changes requires flexibility in trading strategies. As new information becomes available or market conditions shift, traders should be prepared to adjust their approaches accordingly. For instance, if a major upgrade to the Ethereum network is announced, it may be prudent to reassess your trading strategy based on potential impacts on ETH’s price.

By remaining vigilant and adaptable, traders can navigate the complexities of the cryptocurrency market more effectively and position themselves for success in their trading endeavors.

You must be logged in to post a comment Login